News

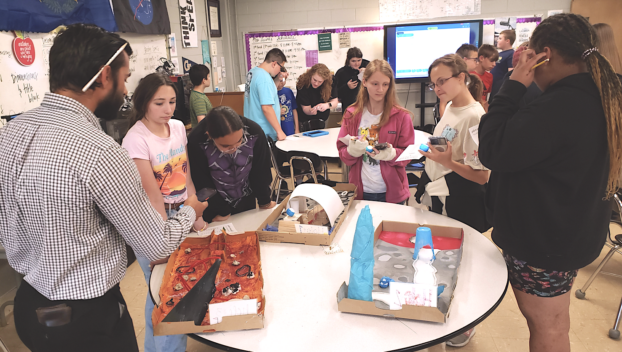

Middlesboro STEM teachers team up for cross-curricular project

In February five educators from the Middlesboro School System attended the SEEC Conference, (Science Exploration Educators Conference) in ...

In February five educators from the Middlesboro School System attended the SEEC Conference, (Science Exploration Educators Conference) in ...

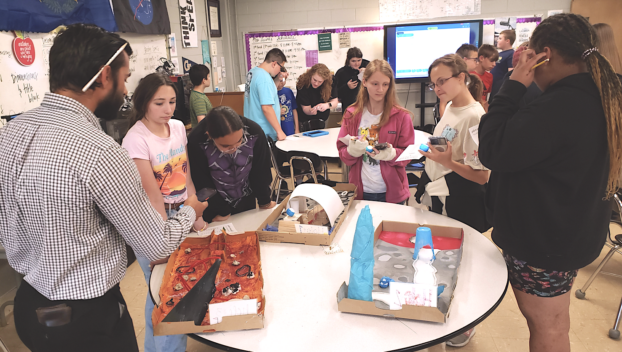

Cooperative Christian Ministry will be holding a free drive-thru food distribution on Wednesday, April 24 at the old ...

The Center for Rural Development has selected Bell County students Hailey Sanders and Malley Smith to attend the ...

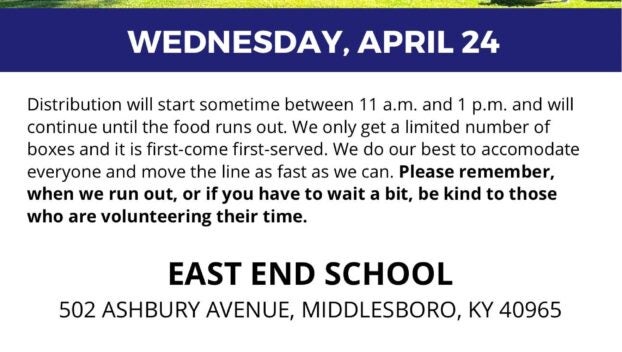

Deacon Barnes of Yellow Creek School Center has been named the Upper Cumberland District winner in the “AARP ...

Representatives from Appalachian Regional Healthcare gathered with local and state officials Friday for a special ceremony during which ...

A week after he replaced John Calipari at Kentucky, Mark Pope made his first post on social media, ...

Kentucky’s seasonally adjusted preliminary March 2024 unemployment rate was 4.5 percent, according to data released Thursday by the ...

Average gasoline prices in Kentucky have fallen 1.8 cents per gallon in the last week, averaging $3.30/g today, ...

By Steve Roark Contributing Writer Wild ginger (Asarum canadense) is an interesting plant found in rich, moist, ...

Bell County deputies arrested a Harlan man on multiple charges following a traffic stop on 25E in Pineville ...

Reed Sheppard is ready to pursue his next dream. The Kentucky freshman guard declared for the NBA Draft ...

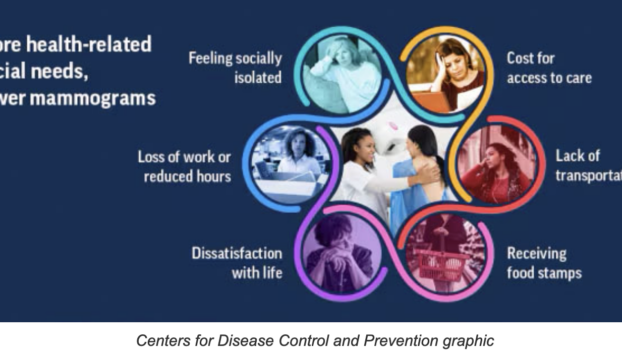

A Centers for Disease Control and Prevention study says the more health-related social needs a woman has, the ...

Kentucky State Parks continue to celebrate their 100th anniversary with a series of events in April. Cumberland Falls ...

The Bell County Board of Education took time to recognize a wide range of students who had placed ...

The Bell County Recycling Center and Bell County Solid Waste will be celebrating Earth Day on Monday, April ...

Middlesboro Mayor Boone Bowling invited everyone to come out to the city’s first ever strategic planning workshop on ...

The U.S. Food and Drug Administration (FDA) along with the Centers for Disease Control and Prevention (CDC) are ...

A Kentucky death row inmate, who pleaded guilty in 1998 of murdering a teenage girl in Caldwell Circuit ...

By Dave Ramsey Syndicated Columnist Dear Dave, I have a roommate, and we’ve shared the same two-bedroom ...

This hasn’t been a typical season for Louisville’s baseball team, and it got worse Tuesday night, leaving coach ...

The Middlesboro Board of Education discussed purchasing new security doors and equipment starting at the elementary school during ...

Edward Jones financial advisor David Whitlock of Middlesboro was named among the 2024 Best-in-State Wealth Advisors by Forbes ...

Vince Marrow still remembers the doubts many had when he arrived at Kentucky with new coach Mark Stoops ...

Secretary of State Michael Adams, in his role as Kentucky’s Chief Election Officer, is reminding everyone that the ...

It was quiet in the House and Senate chambers on Tuesday, as members of the General Assembly wrapped ...