News

DEA drug take back day is Saturday

The Drug Enforcement Administration (DEA) has announced that Saturday will be the next National Prescription Drug Take Back ...

The Drug Enforcement Administration (DEA) has announced that Saturday will be the next National Prescription Drug Take Back ...

A Woodbine man, who allegedly cut/stabbed corrections officers at the Whitley County Detention Center during an incident last ...

The 2024 National Day of Prayer will be Thursday, May 2. Both the City of Middlesboro and City ...

The Pineville Independent School Board heard from teacher Kim Yates and a group of students who were able ...

In February five educators from the Middlesboro School System attended the SEEC Conference, (Science Exploration Educators Conference) in ...

A Middlesboro man has been booked into the Bell County Detention Center on charges of violating a Kentucky ...

Kentucky coach Mark Pope officially added another player to his roster on Tuesday. Drexel forward Amari Williams, the ...

The Kentucky Department of Fish and Wildlife Resources will host its semi-annual live auction to sell surplus items ...

The Department of the Interior announced Wednesday the awarding of $36.9 million in the first phase of formula ...

By Billy Holland Columnist Have you considered that most individuals are convinced that what they believe is true, ...

The U.S. Department of Labor has awarded $1.7 million to Southeast Kentucky Community and Technical College (SKCTC) to ...

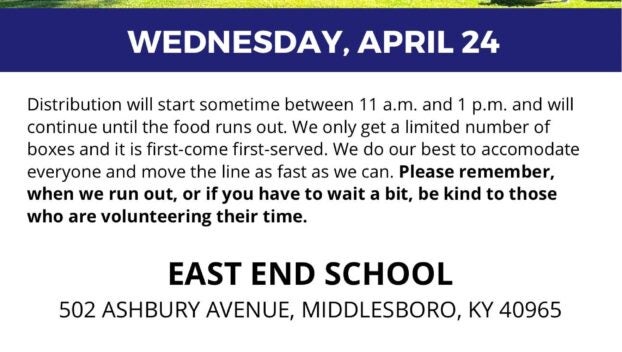

Cooperative Christian Ministry will be holding a free drive-thru food distribution on Wednesday, April 24 at the old ...

YahooSports NBA draft analyst Krysten Peek has Kentucky guard Reed Sheppard going No. 6 in the NBA draft ...

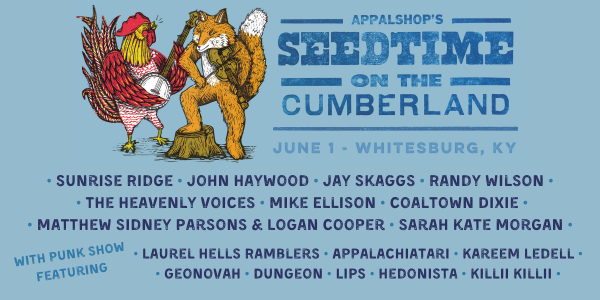

Kentucky Lantern Appalshop has announced the lineup for Seedtime on the Cumberland June 1 in Whitesburg. The free ...

The Kentucky Transportation Cabinet (KYTC) reminds political candidates, residents, business operators and property owners along US and KY ...

By Jack Godbey Columnist It seems that everyone has a cell phone. I even saw a panhandler standing ...

The Center for Rural Development has selected Bell County students Hailey Sanders and Malley Smith to attend the ...

A week after he replaced John Calipari at Kentucky, Mark Pope made his first post on social media, ...

Kentucky’s seasonally adjusted preliminary March 2024 unemployment rate was 4.5 percent, according to data released Thursday by the ...

Average gasoline prices in Kentucky have fallen 1.8 cents per gallon in the last week, averaging $3.30/g today, ...

By Steve Roark Contributing Writer Wild ginger (Asarum canadense) is an interesting plant found in rich, moist, ...

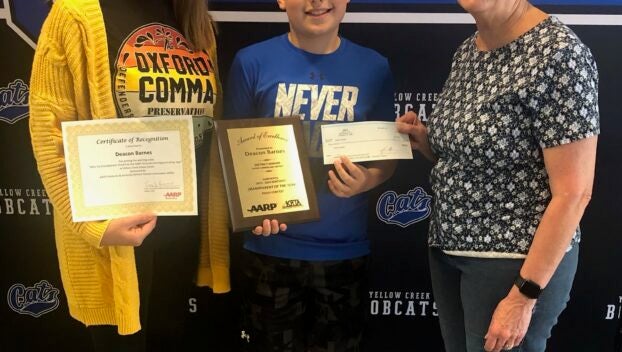

Deacon Barnes of Yellow Creek School Center has been named the Upper Cumberland District winner in the “AARP ...

Bell County deputies arrested a Harlan man on multiple charges following a traffic stop on 25E in Pineville ...

Representatives from Appalachian Regional Healthcare gathered with local and state officials Friday for a special ceremony during which ...

Reed Sheppard is ready to pursue his next dream. The Kentucky freshman guard declared for the NBA Draft ...