News

Blondell presented Leadership Award at Chamber’s Women in Business Dinner

Former Bell County Commonwealth’s Attorney Karen Greene Boondell received a surprise honor at last week’s Women in Business ...

Former Bell County Commonwealth’s Attorney Karen Greene Boondell received a surprise honor at last week’s Women in Business ...

A tragedy was avoided along the Cumberland River last week thanks to Conservation Officer Derek Creech being in ...

The City of Middlesboro observed the National Day of Prayer last Thursday with a special service in the ...

A Middlesboro man has been charged with burglary, terroristic threatening, disorderly conduct, menacing, resisting arrest, and criminal mischief ...

The Bell County Board of Education has voted unanimously to implement a substantial pay raise for the upcoming ...

A Middlesboro man was charged with assault, burglary, unlawful imprisonment, tampering with physical evidence, and possession of a ...

Crater of Hope honored two young ladies with a surprise graduation party at their regular board meeting Monday ...

Kentucky coach Mark Pope added another veteran guard to his roster on Thursday with the addition of West ...

Andru Phillips has wanted to play in the National Football League for as long as he can remember ...

Kentucky counties can now apply for $4,000 in waste tire recycling and removal grants, which are made available ...

By McKenna Horsley Kentucky Lantern Kentucky Republican Attorney General Russell Coleman is leading a new multi-state lawsuit ...

A Middlesboro man who was wanted for vehicle thefts was arrested on Tuesday and additionally charged with fleeing ...

The Bell County Hall of Fame held its induction ceremony and dinner for the class of 2023-24 on ...

Lady Lions stretch win streak to five The Pineville Lady Lions continued their streak of strong play by ...

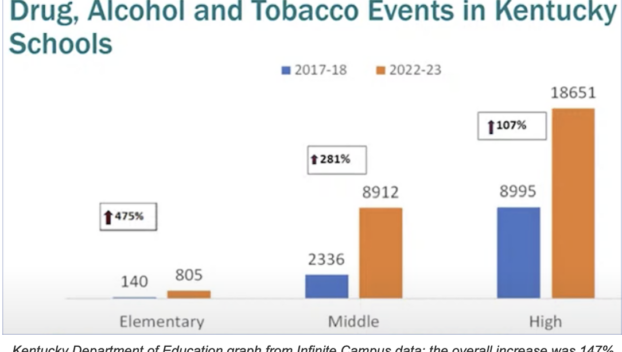

The number of drug, alcohol and tobacco events recorded by schools have increased in schools at all levels ...

Whether you ride, pedal or drive, Kentuckians are reminded that May is National Motorcycle and Bike Safety Awareness ...

Kentucky native John Morris has been the signature voice of Baylor athletics for almost 30 years and while ...

Twenty-nine school districts will be participating in this year’s Summer Boost: Reading and Mathematics Program, a partnership between ...

By Sarah Ladd Kentucky Lantern Kentucky researchers are developing and expanding a virtual reality treatment for eating disorders ...

By Billy Holland Columnist It’s wonderful to be positive-minded and appreciate that God is good all the ...

Bob Dixon has been appointed as a new agency manager with Kentucky Farm Bureau (KFB) Insurance at the ...

KCTCS President Ryan Quarles has announced the appointment of Dr. Patsy Jackson as interim president of Southeast Kentucky ...

Kentucky coach Mark Pope’s first roster is starting to come together with the addition of two more guards ...

By Jack Brammer Kentucky Lantern Former Kentucky Secretary of State Alison Lundergan Grimes was cleared Monday by Franklin ...

An Attorney General’s Opinion released on Monday addresses whether people on home incarceration may be arrested and charged ...